UK Retail - Christmas 2025 Trading

Why some brands became top-of-mind, and others were just noise.

In the sea of seasonal sameness, 2025 was a year of reckoning for UK retail. While the headlines focus on record-breaking revenues for the likes of Aldi and Tesco, the real story lies beneath the surface of the data. It’s a story of Motivation vs. Memorability.

This Christmas, we saw a clear divide: retailers who understood the psychological drivers of their audience, and those who simply paid the "Dullness Tax" - the high cost of being noticed but immediately forgotten.

1. Beyond the Shouting Contest: Solving the Motivation Gap

The biggest mistake we saw this year was retailers mistaking noise for motivation. Shouting about a 20% discount is a tactic, not a strategy. True motivation comes from solving a problem or fulfilling a psychological need.

The Problem: Many brands spent millions on "interruption marketing" that shoppers expertly tuned out.

The Opportunity: Highly memorable brands are up to 3x more effective in their marketing spend. They don't just reach people; they rewire how people think and choose.

The Reality: Shoppers will not act without the right motivation. If your brand isn't perceived as the "top answer" to their specific need - much like how we treat Alexa - you’ve already lost.

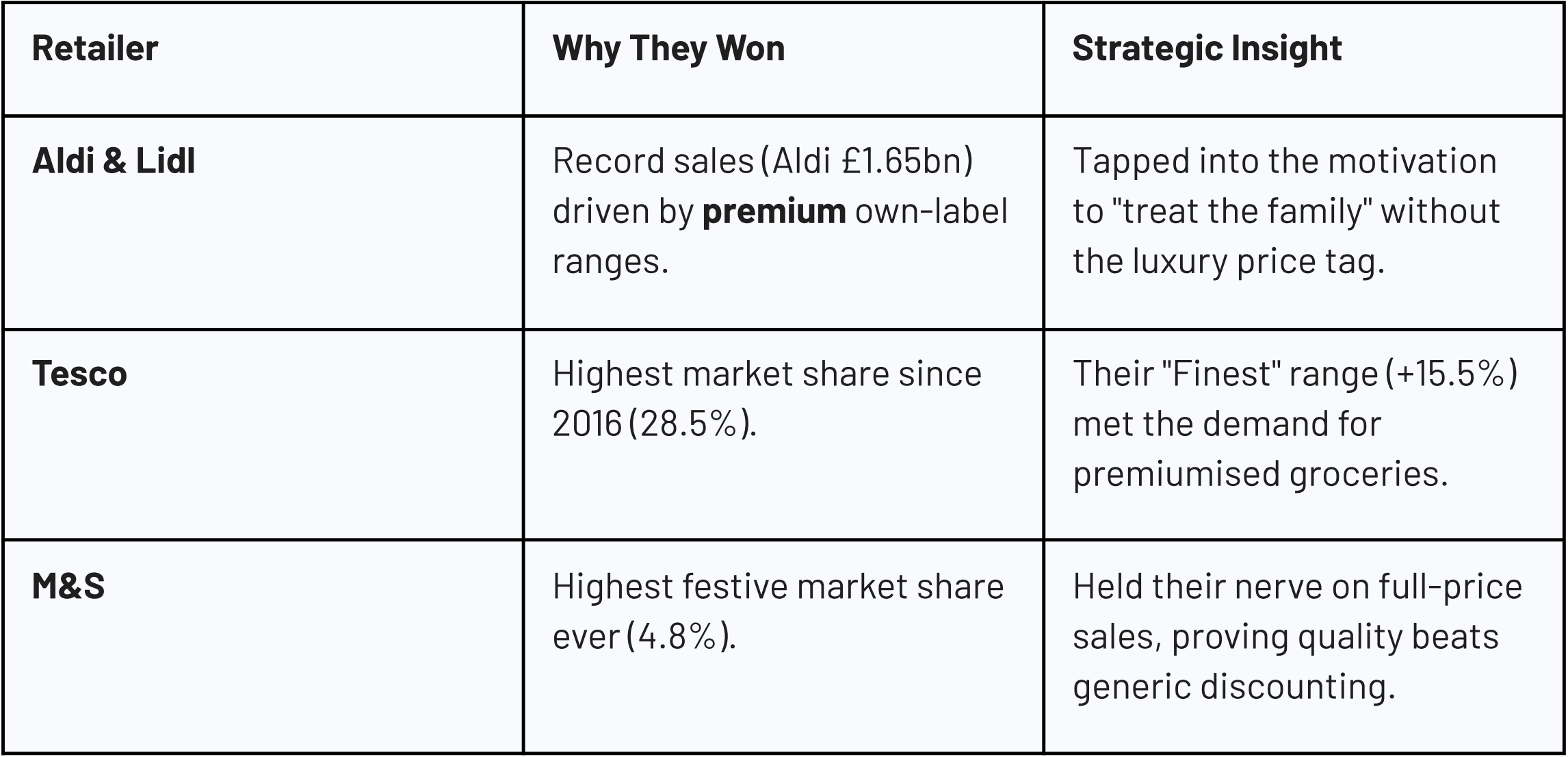

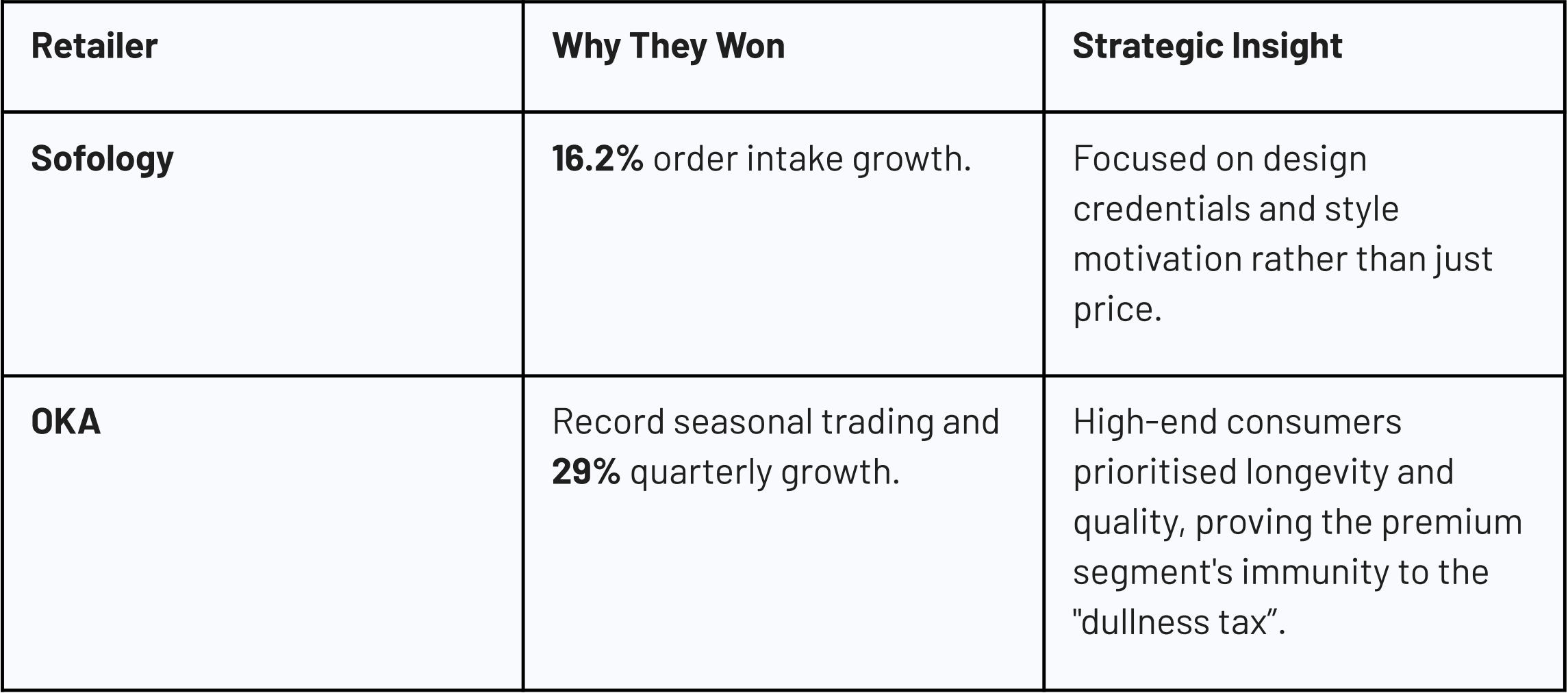

2. Deciphering the Winners: Who Won the "Motivation Gap"?

The winners in 2025 focused on "affordable indulgence" and "quality-first" mindsets.

Tesco & Aldi: With Tesco’s "Finest" range up 15.5% and Aldi hitting £1.65bn in sales, these retailers leveraged the "treat brain". They tapped into the motivation to "treat the family" with luxury-tier quality without the luxury price tag.

M&S: By achieving their highest festive market share (4.8%) while resisting generic discounting, M&S proved that Quality beats noise. They didn't devalue their brand to chase a sale; they stayed unignorable by doubling down on their design credentials.

OKA & The Cotswold Company: The value of longevity. A 29% surge for OKA proves that even in a cautious economy, high-end consumers prioritise craftsmanship. This is the Endowment Effect in action: we value what we believe will last.

3. Sector spotlight: Home & furniture

The global home improvement market is projected to reach $2,659.6BN by 2032, and 2025 was a bellwether year for this sector.

The IRL advantage: Despite the digital surge, real-world experiences are vital. Brands like Feather & Black saw visibility surges of 66% by using in-store design stations. These stations act as behavioral "nudges," lowering the friction of a big-ticket purchase by letting Gen Z and Millennial shoppers visualize the "dream home" journey in person.

The "decisive shopper" paradox: Consumer confidence rose to -17 in December, but Super Saturday visits fell 6.9%. Shoppers were waiting for "meaningful" offers, not just any offer. They weren't browsing; they were hunting.

4. Strategic Challenge: Are you paying a "Dullness Tax"?

As a Senior Marketer, you must ask: Is your brand a "Top Answer" or just another search result?

Relevance check: Is your creative solving a genuine consumer problem (status, comfort, efficiency), or is it just part of the background noise?

Memorability check: If you removed your logo, would your brand voice and creative still be recognizable? A unique brand voice is a secret weapon for building trust and standing out in a crowded market.

Consistency check: Are you building brand memory across every touchpoint, from social commerce to the in-store shelf?

6. How to can win in 2026

We solve marketing problems by pairing sharp, behaviour-led strategy with memorable creativity.

One of our programs could be the answer to your biggest marketing challenge:

Experience Lift: Transform your entire brand experience at every touch point.

Brand Renovation: Turn a tired, forgettable brand into one that’s totally un-ignorable.

Retail Future: A future-focused program that reimagines retail spaces, formats and experiences to meet changing shopper expectations.

Or, get in touch to hear more about our unique One More Thing program. It’s the application of behavioural science to engineer cues that drive incremental revenue for bricks and mortar stores.